Posted by Chris L. Raddatz

Opportunity Zones and Opportunity Funds—A Win-Win for Investors and Low-Income Community Businesses

An often-overlooked program enacted as part of the Tax Cuts and Jobs Act creates Opportunity Zones to incentivize economic development and job creation in low-income communities. The new program, outlined in new Internal Revenue Code sections 1400Z-1 and -2, allows unlimited amounts of otherwise taxable capital gains to be deferred and subsequent earnings on capital gains invested in Opportunity Funds to be forgiven altogether. To defer the gain, a taxpayer must invest the proceeds from the sale into an Opportunity Fund within 180 days in an amount equal to the gain being deferred.

What are Opportunity Zones?

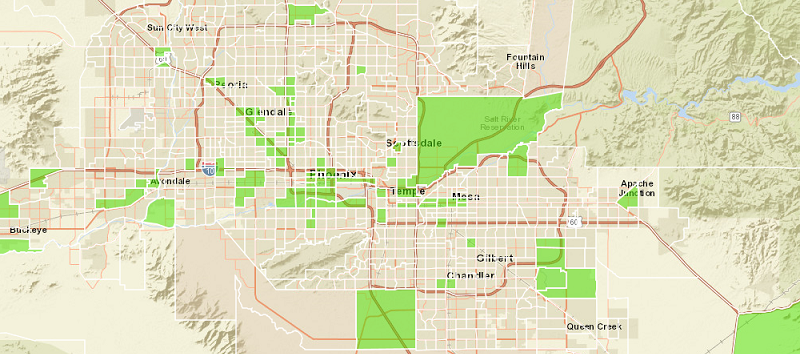

“Opportunity Zones” are low-income communities determined by qualifying population census tracts. Governors of each state nominate up to 25% of such census tracts in their state, by not later than March 21, 2018, as Opportunity Zones. The Secretary of the Treasury then has thirty days to approve and certify the qualifying tracts. A “qualified census tract” is generally a census tract that has a poverty rate of at least 20% or a median income that does not exceed the higher of 80% of the median income in the metro area or the statewide median income. The Opportunity Zones nominated by Governor Ducey can be found at the following link:

What is an Opportunity Fund?

An Opportunity Fund is any corporation or business that invests at least 90% of its assets in Opportunity Zone businesses. While the Opportunity Fund must be “certified” under rules to be promulgated by Treasury, the statutes are silent. However, legislative history suggests the certification process is intended to be similar to the “community development entity” certification process under the New Market Tax Credit program.

What is an Opportunity Fund Business?

To qualify as an “Opportunity Fund Business,” substantially all of the tangible assets of the business must be used in the Opportunity Zone, at least 50% of the gross income earned by the business must be from active conduct of business in the Opportunity Zone, and there are limits on the amount of investment property that can be held. With the exception of so-called “sin businesses,” most any type of business will be permitted.

What Type of Property Can Be Sold and the Proceeds Contributed?

The property being sold to fund the Opportunity Fund can be almost anything. Real property, stock, business assets and personal assets may all be used. Notably, the property being sold does not need to be within or in any way connected to the Opportunity Zone.

If you would like any additional information about Opportunity Zones, or

need assistance understanding your property’s potential benefits, please

reach out to Chris Raddatz.

Download the full Legal Alert about Arizona Opportunity Zones and Funds in Arizona.